When we take out health insurance, the policy’s terms and conditions usually refer to waiting periods. But, what are waiting periods? Why do they exist? How do they work? If you are considering taking out private medical insurance, it is important to know what a “waiting period” is so that you know when you can start to use the healthcare services included in your policy.

When it comes to what insurance waiting periods are, the Spanish Association of Insurers (UNEPSA), through its We Are Safe initiative, provides a simple and helpful explanation:

-

An insurance waiting period is a period in which you cannot yet benefit from the healthcare services you have taken out.

-

Waiting periods do not apply to all healthcare services, just the ones specified in the insurance policy.

Briefly put, a waiting period in a private healthcare insurance policy is the length of time an insured person must wait until they can access the healthcare services. And this period can vary depending on the insurance company.

Be careful not to confuse “waiting period” with “co-payment”. A co-payment is what allows policyholders to lower their premium and it involves paying part of the healthcare service included in the policy when it is used. At Adeslas, we adapt to your needs and we offer insurance policies with co-payments and insurance policies without co-payments. The choice is yours!

In terms of how a waiting period for private medical insurance works, it’s best to look at a practical example:

-

On the 1st of June, 2024, a man takes out a medical insurance policy which has a 6-month waiting period for vasectomies.

-

If, following this, his family decides to prevent pregnancy and the insured individual submits to this surgery, he will not be able to do so with his health insurance until the 6-month waiting period ends.

-

From the 1st of November, 2024, once the waiting period is over, he can then discuss the matter with his physician to see if he can have a vasectomy under his insurance policy.

As with other insurance firms, Adeslas health insurance policies include waiting periods for a series of special treatments, which are categorised into 3-month, 6-month and 8-month periods.

-

High-tech diagnostic methods.

-

Outpatient surgical interventions (Group 0 to 2 according to the Spanish College of Physicians).

-

Laser photocoagulation treatments in ophthalmology, as well as laser therapy in muscular-skeletal rehabilitation.

-

Percutaneous nucleotomy.

-

Interventional diagnostic methods.

-

Tubal ligation and vasectomy.

-

Hospitalisation for any reason or of any kind, either as an in-patient or at the day hospital, as well as surgical interventions performed under these bases.

-

Cost of surgical implants and prostheses (the waiting period does not apply to surgical interventions that take place as a result of a life-threatening emergency).

-

Labour or cesarean section (in surgical interventions and difficult deliveries which take place as a result of a life-threatening emergency, the waiting period does not apply. Nor does it apply in premature deliveries, i.e. deliveries that occur before reaching 28 weeks’ gestation.)

-

Laser therapy for colorectal surgery; in surgical interventions in gynaecology, otorhinolaryngology (ENT) and dermatology; in interventions for benign prostatic hyperplasia; in urinary tract lithotripsy; and in endoluminal treatments for varicose veins and tracheobronchial lesions.

-

Pain treatment.

-

Dialysis.

-

Shock waves for musculotendinous calcifications.

-

Renal lithotripsy.

-

Chemotherapy and radiotherapy oncology.

It is worth bearing in mind that all private medical insurance policies at Adeslas are different and vary in price, coverage and waiting periods.

-

In the Adeslas GO access policy, all the guarantees included can be accessed immediately, except for high-tech diagnostic methods which, as we mentioned before, have a 3-month waiting period.

-

However, the Adeslas PLENA VITAL, Adeslas PLENA, Adeslas PLENA PLUS, Adeslas PLENA TOTAL, Adeslas PLENA EXTRA 150 MIL, Adeslas PLENA EXTRA 240 MIL and Adeslas PREMIER policies are more comprehensive and include more 3-month, 6-month and 8-month waiting periods.

-

And Adeslas SENIORS and Adeslas PLENA TOTAL SENIORS are health insurance policies designed to cover the needs of older adults. These can be taken out from age 55. As with the Adeslas PLENA policies, waiting periods range from between 3 and 8 months.

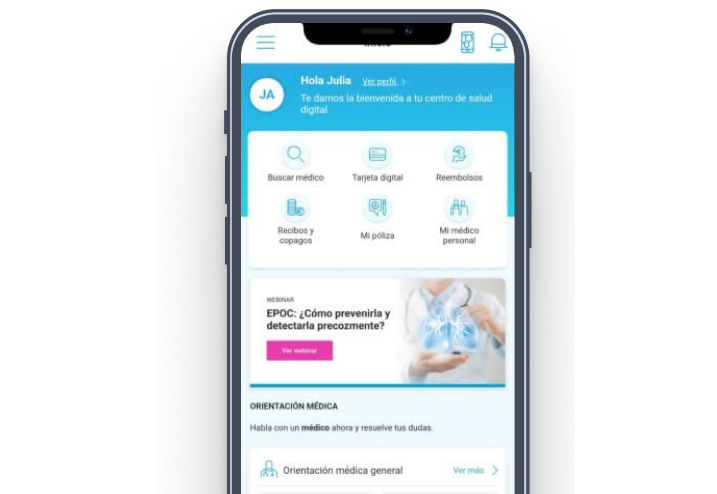

All our health insurance policies give customers access to a large medical team with over 51,000 professionals, more than 200 private hospitals and over 1,400 medical centres. And, among other benefits, customers can take advantage of the digital medical care and healthcare provision.

If you need more information about the different options for private medical insurance policies and the coverage, healthcare provision and waiting periods for each of these, you can speak to us by telephone or through our contact channels, or in our customer service offices. You can also see an insurance broker who is part of the Adeslas agency network.

If you are now wondering why there are waiting periods, you need to understand that these are largely in place to prevent people from abusing the policy.

-

Without waiting periods, people could take out a private medical insurance policy only when they had an illness or needed expensive treatment,

-

and cancel the policy after having had a test, surgery or treatment.

With waiting periods, Adeslas is assured this insured individuals use the healthcare provision that the insurance firm provides responsibly.

Frequently asked questions

The waiting periods appear in the policy’s terms and conditions. Moreover, at Adeslas, we provide specific documents that insured individuals can read for themselves.

A waiting period can sometimes be confused with an exclusion period. Two concepts which, as we explain below, are quite different:

-

Waiting period. This means that a certain length of time has to pass before an insured person can enjoy a particular healthcare service.

-

Exclusion period. This refers to the length of time in which certain healthcare services are not covered by the policy, regardless of how much time has passed since the policy was taken out.

No. Emergency medical care is not subject to waiting periods.