Health services

Take advantage of the benefits of your Adeslas private health insurance

Our health insurance policies

Compare and choose the medical insurance that suits you best.

ESSENTIAL INSURANCE

Adeslas GO

The most essential is always covered

Immediate access to specialists.

-

Extensive outpatient, speciality and diagnostic resource coverage

-

Without health questionnaire

-

Annual medical check-up (with copayment)

20€ From insured/month

THE BEST-SELLING INSURANCE

Adeslas Plena Total

Comprehensive health and dental coverage

With hospitalisation, no copayments and dental care at the same price for three years

-

Extensive coverage, including hospitalisation

-

Free annual medical check-up

-

Reimbursement of pharmacy, rehabilitation, physiotherapy, speech therapy, phoniatrics and podology expenses

-

Accident coverage of up to €30,000

-

Up to €100,000 in travel assistance abroad

80€ From insured/month

WITH ALL THE PROTECTION AND ACCOMPANIMENT INCLUDED IN IT

Adeslas Plena Total Seniors

Comprehensive health and dental coverage for seniors

Includes health and dental coverage at the same price for three years

-

Extensive coverage, including hospitalisation

-

Medical Health Advisor

-

Annual medical check-up

-

Up to €30,000 in travel assistance abroad

99€ From insured/month

ESSENTIAL INSURANCE

Adeslas GO

The most essential is always covered

Immediate access to specialists.

-

Extensive outpatient, speciality and diagnostic resource coverage

-

Without health questionnaire

-

Annual medical check-up (with copayment)

20€ From insured/month

Adeslas Plena Vital

The best value for money

With hospitalisation and copayments.

-

Extensive coverage, including hospitalisation

-

Reimbursement of rehabilitation, physiotherapy and podology expenses

-

Up to €12,000 in travel assistance abroad

37€ From insured/month

Adeslas Plena

Extra-low costs

With hospitalisation and low copayments

-

Extensive coverage, including hospitalisation

-

Reimbursement of rehabilitation, physiotherapy and podology expenses

-

Up to €12,000 in travel assistance abroad

49€ From insured/month

Adeslas Plena Plus

Without any extra costs

With hospitalisation and no copayments.

-

Extensive coverage, including hospitalisation

-

Reimbursement of rehabilitation, physiotherapy and podology expenses

-

Up to €12,000 in travel assistance abroad

59€ From insured/month

THE BEST-SELLING INSURANCE

Adeslas Plena Total

Comprehensive health and dental coverage

With hospitalisation, no copayments and dental care at the same price for three years

-

Extensive coverage, including hospitalisation

-

Free annual medical check-up

-

Reimbursement of pharmacy, rehabilitation, physiotherapy, speech therapy, phoniatrics and podology expenses

-

Accident coverage of up to €30,000

-

Up to €100,000 in travel assistance abroad

80€ From insured/month

Adeslas Seniors

Comprehensive coverage for seniors

Tailored accompaniment with hospitalisation

-

Extensive coverage, including hospitalisation

-

Medical Health Advisor

-

Up to €12,000 in travel assistance abroad

65€ From insured/month

WITH ALL THE PROTECTION AND ACCOMPANIMENT INCLUDED IN IT

Adeslas Plena Total Seniors

Comprehensive health and dental coverage for seniors

Includes health and dental coverage at the same price for three years

-

Extensive coverage, including hospitalisation

-

Medical Health Advisor

-

Annual medical check-up

-

Up to €30,000 in travel assistance abroad

99€ From insured/month

Adeslas Plena Extra 150 MIL

Comprehensive coverage and free choice in Spain and abroad

Includes hospitalisation, no copayments and with free choice of doctor or centre anywhere in the world through the reimbursement of expenses

-

Reimbursement of expenses outside the medical roster of up to €150,000

-

Extensive coverage, including hospitalisation

-

Reimbursement of rehabilitation, physiotherapy and podology expenses

-

Up to €12,000 in travel assistance abroad

87€ From insured/month

Adeslas Plena Extra 240 MIL

Comprehensive coverage and free choice in Spain and abroad

Includes hospitalisation, no copayments and with free choice of doctor or centre anywhere in the world through the reimbursement of expenses

-

Reimbursement of expenses outside the medical roster of up to €240,000

-

Extensive coverage, including hospitalisation

-

Reimbursement of rehabilitation, physiotherapy and podology expenses

-

Up to €12,000 in travel assistance abroad

108€ From insured/month

Adeslas Premier

Comprehensive coverage and free choice in Spain and abroad

Includes hospitalisation, no copayments and with free choice of doctor or centre anywhere in the world through the reimbursement of expenses

-

Reimbursement of expenses outside the medical roster of up to €1,000,000

-

Extensive coverage, including hospitalisation

-

Reimbursement of rehabilitation, physiotherapy and podology expenses

-

Up to €12,000 in travel assistance abroad

153€ From insured/month

Do you have any doubts?

Get in touch with us and we will help you choose your insurance

Frequently asked questions

The answer to all your questions

We sort out all the most frequent doubts when it comes to taking out an Adeslas private health insurance policy.

You can find the insurance that suits you best on our all insurance policies page, by going to one of our sales offices, calling us at 900 50 50 40 or calculating the price of your insurance.

A medical insurance is a contract entered into by an insured party and an insurance company. Its aim is to cover the expenses of the insured party gaining access to healthcare coverage (this coverage is set out in detail in the policy). The insured party can use the insurance by paying a premium, which may either be annual or monthly.

El importe de seguro médico tanto para ti de forma individual, como para una familia, varía en función de diversos factores: El número de asegurados, el tipo de coberturas, la edad de los asegurados... Para poder obtener un precio exacto de lo que te costaría un seguro de salud Adeslas ponemos a tu disposición nuestras oficinas de atención comercial o si lo prefieres puedes contactar en el 900 50 50 40

The price of medical insurance for both you as an individual and for a family varies depending on a variety of factors: The number of insured parties, the types of coverage, the insured parties' age, etc. In order to be able to obtain an exact price an Adeslas health insurance will cost you, we place our sales offices at your disposal or, if you so prefer, you can get in touch with us at 900 50 50 40

There are different ways of classifying health insurances: by outpatient coverage (does not include hospitalisation) or by comprehensive coverage (includes hospitalisation), either with copayment (payment per treatment for a low price) or without copayment (treatments are included in the price), including reimbursement, etc. You can find the insurance that suits you best on our all insurance policies page, by going to one of our sales offices or by calling us at 900 50 50 40.

Yes, it does, provided you cancel your current insurance and sign up for Adeslas on the same day and you submit the bills and the terms and conditions of your current policy which it is still in force.

With Adeslas, the leading firm in health insurance, you will have available:

-

Medical centres with over 45,000 professionals of all specialities.

-

Over 1,300 medical centres and 216 affiliated hospitals

-

25 Adeslas Medical Centres

-

Over 185 Adeslas Dental Clinics

-

More than 259 customer service points

Some insurance policies require the future insured party to complete a prior medical questionnaire. After its assessment by the insurance company, the insurance application may be rejected or may be approved, though excluding some illnesses from coverage. For more information on this issue, you can get in touch with one of our sales offices or call 900 50 50 40.

In order to insure your child or any other family member either individually or as a beneficiary of an already existing policy, you can go to one of our sales offices or call 900 50 50 40.

You can start using your Adeslas insurance from the moment you have your policy number. Remember that in order to request some medical tests or interventions, you must have been insured by Adeslas for a certain period of time. This is the so-called waiting period.

In order to request some medical tests and interventions, you must have been insured with Adeslas for a certain period of time.

They are amounts you have to pay to access certain services. They allow you to balance the monthly payment of your insurance.

Reimbursement of expenses involves refunding the customer a high percentage of the invoice paid when they go to a specialist or medical centre anywhere in Spain or the world that is not included in the Adeslas Medical Roster.

Reimbursement of expenses only applies to the company's products set out below:

For individuals: Adeslas Extra 150 Mil, Adeslas Extra 240 Mil, Adeslas Premier.

Yes, we offer an online medical counselling service. You just have to go to Medical Counselling to access it. Select the option you prefer to get in touch with one of our doctors (by telephone, video call or online). Aside from seeing the appointments you have made or the consultations you have sent, you can make an appointment or send a consultation.

You also have available the teleconsultation or video consultation service with the doctor of your choice who has this option. We explain how it works here.

E-prescriptions are an advance that speed up the service, avoid unnecessary travel and facilitate monitoring by doctors.

E-prescriptions allow you to obtain the prescriptions issued by a specialist conveniently by e-mail. They therefore complement the video consultations and telephone consultations you make with your doctor perfectly.

Results can be filtered on the medical roster to know a certain care provider's preferred language. The check marks will be enabled as long as this option exist in the province being queried. If this option does not exist, the filters will be disabled.

Once a search of the medical roster has been done by speciality, one can filter to see whether the provider offers their consultations in English, French or German.

This service can be requested by insured parties who have been diagnosed with some of following diseases: cancer, cerebral embolism or thrombosis, myocardial infarction or other coronary diseases. A healthcare coordinator will help sort out any doubts and plan the services you need at such a difficult time, offering you all the information you need at all times and setting guidelines to help you cope with the disease better. Should you need it, you can request this service here.

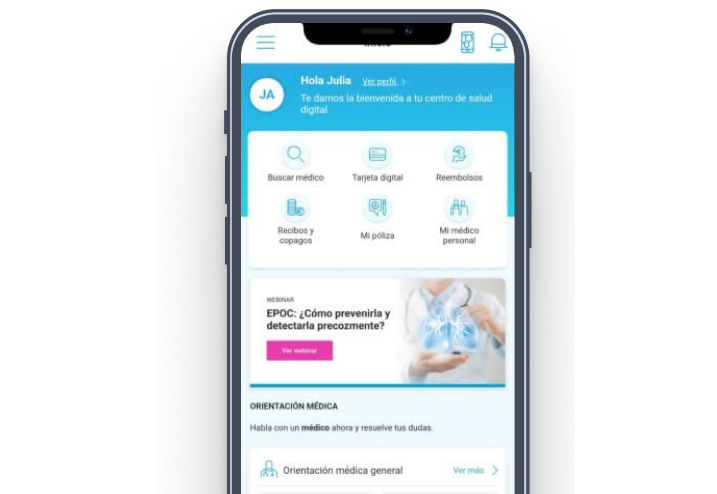

In order to obtain and use of your Adeslas digital card, you must access your Customer Area in the Digital Card section or on the Adeslas app.

-

Go to your Customer Area in the Reimbursements section.

-

Choose the type of reimbursement you want to request and check the documents you have to submit. Select the insured party and complete the data requested.

The medical centre or the professional will tell you if you need a prior authorisation to undergo the medical action prescribed. If you have any doubts, you can get in touch with your Adeslas customer service office or contact the 24-hour Customer Service Department at 900 50 50 40.

The healthcare benefits which usually require authorisation are the following:

-

Surgical interventions, including childbirth if is a scheduled birth, and hospitalisations, even if they are outpatient hospitalisations.

-

High-tech medical diagnostic tests, including: MRIs, CT scans, PET-CT scans, colonoscopies, endoscopies, high-definition ultrasound, sleep studies, etc.

-

Respiratory therapies such as aerosols, oxygen and CPAP.

-

Rehabilitation, physiotherapy and speech therapy.

-

Oncology treatments such as chemotherapy, radiotherapy, immunotherapy, etc.

-

Psychotherapy.

-

Birth preparation.